Can a volatile asset like $TOPIA serve as both an in-game currency and an investment vehicle? Or are these roles at odds with each other?

Let’s say Loot Legends launches and spreads like wildfire.

A month later, HYTOPIA’s open beta, which’ll be backwards compatible with Minecraft, rolls out and crushes it as well.

Suddenly, HYCHAIN is buzzing with millions of players – here for the games, not the crypto.

Amazing! One huge hurdle cleared.

$TOPIA explodes in value, and every bagholder is euphoric, taking victory laps on X.

Great, no complaints here – I fully expect this to happen.

But now, I’m starting to think about sustainability.

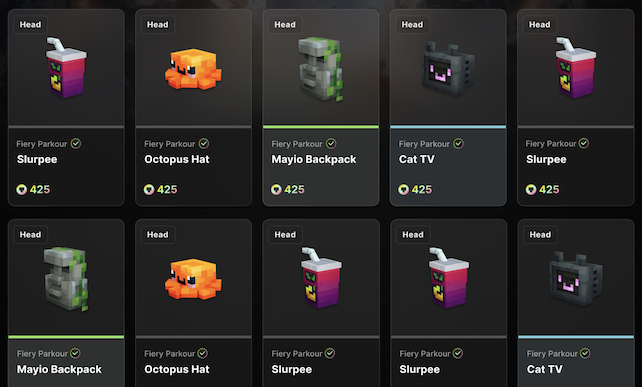

Both of these games, and likely many more that will run on HYCHAIN, are expected to use a dual currency system.

This means players will have two options:

- They can use $TOPIA, the native token, for in-game purchases, or…

- They can use $USDC, a stablecoin pegged to the dollar, for their transactions.

Ark and Temp will incentivize the former by dangling discounts and perks if you pay with $TOPIA.

How come?

Because everyone benefits:

- The HYCHAIN foundation takes a small fee, which helps fund development and operations.

- Players get the homie hookup – either saving money or scoring extra goodies that aren’t available when paying with $USDC.

- And investors enjoy steady buying pressure on the coin, helping “number go up” for $TOPIA.

What’s not to like, right?

Ah, not so fast.

It’s not all popsicles and baby giggles.

Think about it:

What happens when $TOPIA increases 50X?

The $TOPIA you bought early on is now worth 50 times as much.

But if you spend it to save 30% on Hero Pets in Loot Legends, you’re essentially giving back all those gains, aren’t you?

It doesn’t make sense financially.

You might decide to hoard it instead, hoping it’ll go up even more. Or convert it back to $USDC to lock in your profit.

And herein lies the problem: this behavior reduces the utility of $TOPIA within the ecosystem.

Now, consider the brutal bear markets in crypto.

Hypothetically:

What happens when $TOPIA plummets 81%?

If you loaded up on $TOPIA before it nuked, you’d be pissed, wouldn’t you?

You’d probably panic sell, along with others, creating a downward spiral that exacerbates the price drop.

Us degens love the volatility – that’s why we’re here.

But wouldn’t this weird the players out? Confuse them? Anger them?

Would they not complain and warn others to stay away from $TOPIA?

If so, could this cause a domino effect, leading to fewer transactions, less engagement, and a potential decline in the game’s popularity?

Or am I overthinking it?

Maybe the issues I’ve outlined aren’t as dire as they seem.

Maybe the millions of players flocking to HYCHAIN games like HYTOPIA and Loot Legends won’t give a second thought to the value of $TOPIA outside the game.

Or even if they’re aware of the volatility, if the fun factor is strong enough, they’ll still transact in $TOPIA to earn a special loot box, for example.

Plus, let’s not forget, the dual currency system gives players the option to use $USDC if they prefer stability.

And I’m sure Temp and Ark are already two steps ahead.

I could see them cooking up a well-designed in-game economy to absorb the shocks of $TOPIA’s price fluctuations. They probably have token sinks, dynamic pricing, and other creative solutions locked and loaded, hands on their holsters.

Finally, if dual currency blockchain games like Axie Infinity, The Sandbox, and Decentraland have all managed to survive this bear market, doesn’t that prove it’s possible to maintain a token’s utility despite significant price swings?

It really comes down to this:

If I’m topping off my daughters’ accounts with $TOPIA instead of Robux next year, I guess they’ll have figured it out.

My best advice? Don’t let tax season hit you like a truck. Even swapping from one crypto to another is taxable, and the IRS is watching. Read my CoinLedger review and get organized before it’s too late.